Our Workshop Services

Our workshop specialises in jewellery repairs, restorations and remodelling to restringing of pearls, valuations and engraving services.

Jewellery repairs and restoring

Whether it's a broken clasp on a necklace or a missing stone from your engagement ring our team use traditional techniques and modern technology to restore your pieces.

Remodelling jewellery

Our team can transform and redesign old treasured antique and vintage jewellery into new jewels to be worn and enjoyed.

Insurance and probate valuations

It is good practice to have your jewellery revalued every 2-3 years, this provides an up to date description of your precious items in the event of loss or damage.

Signet Rings

Whether it's your family crest, initials or a bespoke design our signet rings are seal engraved which creates a detailed, durable crest. Signet rings are uniquely personal and the traditional method of creating this bespoke ring ensures it can be passed onto the next generation.

Restringing pearls

Over time, pearl strands may weaken, risking the integrity of the piece. Our expert restringing service uses high-quality silk threads and hand-knotting techniques to secure your pearls to remain stunning and secure for years to come.

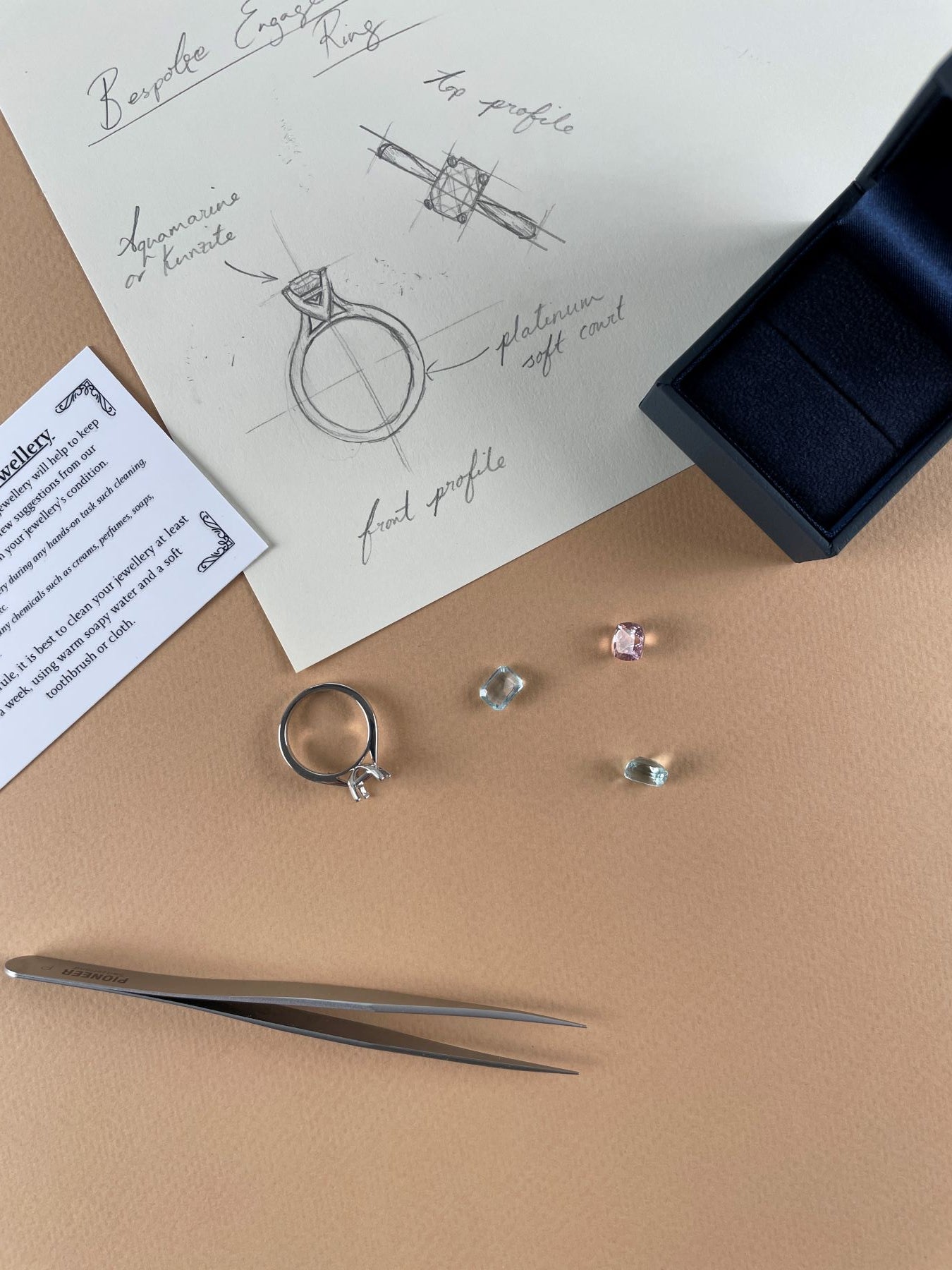

Bespoke

Our designer works with you to create a piece that is uniquely designed. We can re-purpose stones and metal from an existing heirloom or source stones for you.

Watches & Clocks

Our workshop offers expert repairs for a wide range of timepieces, from delicate wristwatches, to a Rolex to grandfather clocks. Whether it's a quick battery change or a thorough service, we can keep your watch running smoothly.

Engraving

We work closely with traditional engravers to engrave jewellery, trophies and beyond. Whether it's a special date to be remembered or a personalised message our engraving service is bespoke to you..

Silver

Our workshop repairs and restores silver items to their original beauty and functionality. Whether you have a cherished heirloom, a damaged piece of flatware, or a tarnished candelabra, our skilled silversmiths are experts in a wide range of repairs.

Discover more

Contact Us

Contact Us